Apple’s AirPods Pro 3 Threatens Duolingo's Language-Learning Empire

Duolingo should worry about Apple's new live translation feature since iOS users account for 71% of its revenues

During Apple’s annual product launch event “Awe Dropping” on September 9th, it introduced AI-powered Live Translation for its latest AirPods Pro 3. Unlike text-based translation apps, the breakthrough enables real-time speech translation directly through AirPods and iPhones, offering an instant solution to language barriers for Apple’s nearly 2 billion installed base.

Although Duolingo isn’t a translation app, Apple’s latest innovation poses an existential threat to the edtech app’s business model. With 47.7 million daily active users (“DAU”) and 46% y/y subscription revenue growth during Q2 2025, Duolingo relies heavily on necessity-driven learnings looking to master new languages for travel and work settings. Yet Apple’s free, instant live translation solution could render such necessity-driven learning obsolete, jeopardizing Duolingo’s subscriptions and DAU growth. Apple’s live translation innovation also threatens iOS user demand for Duolingo lessons – a user cohort that currently accounts for 71% of Duolingo’s revenues.

As AI-driven competition intensifies, the Duolingo stock faces risks of a further valuation reset despite it already being 50% lower from its May peak.

AirPods Pro 3 Live Translation: Beyond Traditional Tools

Unlike text-based apps like Google Translate or Apple Translate, the AirPods Pro 3’s Live Translation feature redefines language barriers in conversation. Users can speak into their AirPods in their native language, and the translated audio will play through the listener’s earpiece, with text transcripts also displayable on an iPhone.

Adoption for the AirPods Pro 3 is expected to be strong. The AirPods currently represent Apple’s best-selling accessory with a 47% penetration rate on the iOS installed base. A strong upgrade cycle is also expected, since the AirPods Pro 3 represents the line-up’s first refresh in two years. The scale of the AirPods’ reach threatens Duolingo as well, as 71% of its revenues currently come from iOS users (15.5% from Google Android users).

Duolingo Subscriptions and DAUs Under Siege

The conversational focus of Apple’s newest live translation feature undermines Duolingo’s core value – learning languages for practical needs. Necessity-driven learners currently fuel Duolingo’s 10.9 million paid subscribers and 46% y/y subscription revenue growth in Q2, given their commitment to daily lessons for fluency. By offering instant translation, the AirPods Pro 3’s live translation feature could erode this cohort’s motivation for committed learning, leaving Duolingo reliant on less sticky leisure learners. Yet these casual users, which represent the bulk of Duolingo’s 47.7 million DAUs, drive slower growing ad and in-app purchase revenues instead of the higher-margin subscription sales critical to Duolingo’s earnings outlook.

The Duolingo stock’s sensitivity to AI-driven competition is reflected in the 50% decline from its May 2025 peak. This is compounded by investors’ growing concerns about Duolingo’s decelerating DAU growth:

Duolingo emphasizes DAUs over monthly users, noting “language learning is a daily practice”. Yet AI-driven tools like Google’s Gemini-powered live translation offering announced in August, alongside Apple’s equivalent with the AirPods Pro 3 rollout further dampens necessity-based learning, threatening Duolingo’s ability to retain subscriptions and drive revenue growth.

Freemium Model at Risk

Apple’s free live translation feature for its massive AirPods installed base also undercuts Duolingo’s freemium model. As necessity-driven learners shift to instant translation, Duolingo’s growth will hinge on leisure learners who are less likely to convert to paid subscriptions. While Duolingo monetizes its free leisure learners through ads and in-app purchases, these revenue streams grow far slower with less favourable margins than subscriptions. With 71% of Duolingo’s revenue generated from iOS users, Apple’s free live translation tool coupled with its ecosystem dominance will only distract leisure learners from Duolingo lessons, further eroding Duolingo’s DAUs and revenue growth.

This is consistent with management’s guidance for 2H25, which projects decelerating revenue growth of 35.5% in Q3 and 31.1% in Q4. Since the guidance was issued before Apple’s announcement of the live translation feature, Duolingo’s tempered outlook – which already signals DAU and subscription deceleration – now faces greater challenges that could result in an earnings shortfall and a deeper valuation reset.

Quantifying the Valuation Reset

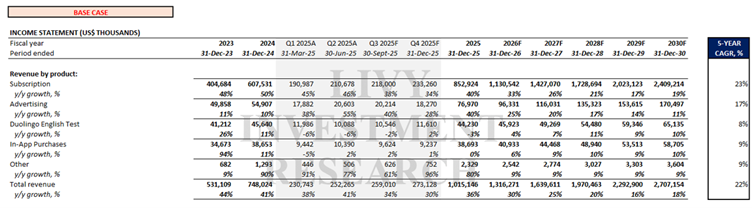

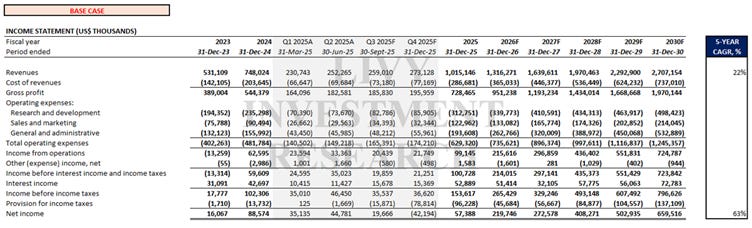

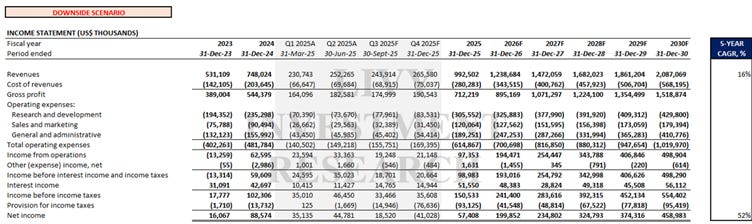

Duolingo’s DAU and subscription revenue growth have been in steady deceleration in the last 12 months. With AI-driven competition intensifying, I forecast revenue growth at a five-year CAGR of 21.7%, reflecting ongoing pressure on necessity-based language learning subscriptions.

Meanwhile, margin improvements are expected, aided by Duolingo’s reduced exposure to Apple App Store commissions in the U.S. Although management expects external purchase flows to reduce the current 30% commission charged by Apple on U.S. iOS subscriptions to only 2% charged by Stripe for payment processing, the actual cost savings are likely to be less impactful. This is because iOS users – the bulk of Duolingo subscribers – still prefer in-app purchases facilitated within the Apple ecosystem for convenience and security.

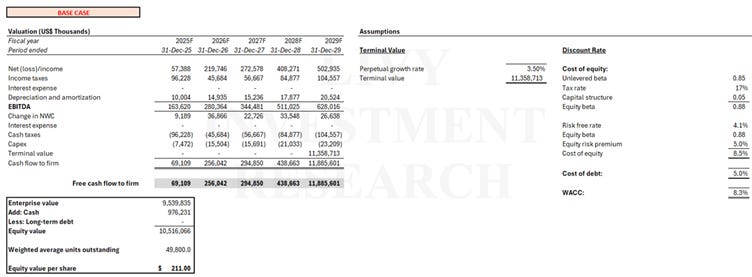

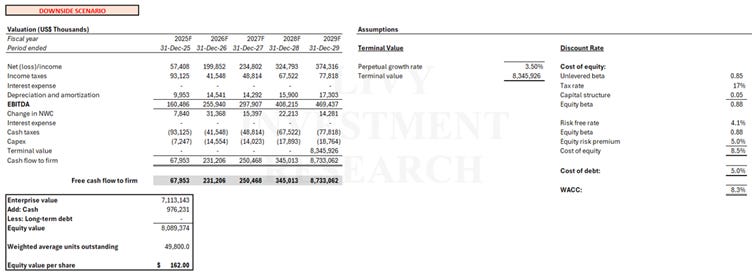

A discounted cash flow (“DCF”) analysis yields a base case price target of $211 per share, assuming a 3.5% perpetual growth rate tied to long-term economic expansion in Duolingo’s core North American market.

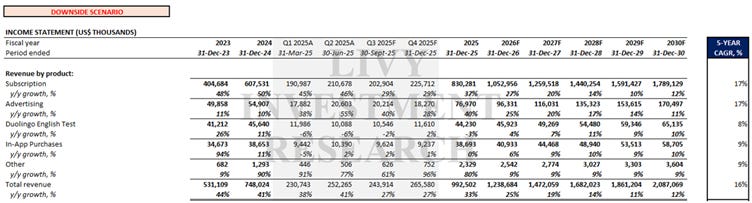

In the downside scenario, where AI disruption further erodes necessity-based learning critical for Duolingo’s subscriptions, the company’s revenue growth could slow to a 17% five-year CAGR. This could push the stock to $162 per share – a level last seen in November 2023. While Duolingo’s recent diversification into chess offers some buffer, the discretionary offering potentially lacks the stickiness of language subscriptions, and does little to reduce the risk of AI-driven churn.

Conclusion

Duolingo’s valuation remains vulnerable to AI-driven disruption, with Apple’s AirPods Pro 3 live translation feature serving as a potent downside catalyst. By enabling seamless multi-lingual conversations, the free iOS-integrated tool threatens the necessity-driven learning that drives 71% of Duolingo’s current revenues.

With more than 500 million AirPods users likely to adopt the upcoming live translation update amid a robust upgrade cycle, Duolingo’s slowing DAU growth and freemium model face mounting pressure. And Duolingo’s recent diversification into chess lessons is unlikely to offset the extent of impending weakness in its core language business. As a result, Apple’s latest live translation feature is poised to weaken Duolingo’s long-term user retention and subscription growth, deepening risks of a valuation reset.

Disclaimer: This analysis is for informational purposes only and represents the opinions of Livy Research. It is not investment advice nor a recommendation to buy or sell the securities discussed.

I use Duolingo daily, but honestly I don’t think it’s that good for actually learning a language. It’s great at keeping you hooked with the streak and daily habit, but not great at helping you really speak or understand the language in conversation. In that sense, Duolingo feels like a completely different use case than something like AirPods with live translation.