My Fundamental-Driven Long Tech Portfolio Construction Process

I looked through 96 tech multi-baggers in 2023 and 2024 so you don't have to.

In the last two calendar years alone (2023 and 2024), more than 500 stocks have delivered a multi-fold rate (i.e., 100%+) of annual value appreciation (“multi-bagged”) across the NYSE and Nasdaq. And it’d only naturally make sense to question “why?” and “how?”.

There was no better way to start finding answers to these simple (yet simultaneously complex) questions than to start digging in retrospect. What exactly had been happening at these companies in the year(s) that led up to their respective multi-bagging journeys?

My quest was to answer these questions, and use that as the roadmap for building my portfolio of fundamental-driven long ideas going forward. Specifically, I wasn’t interested in catalyst-driven upsurges, which were either typically short-lived false dawns or re-rates driven by qualitative factors that aren’t tangibly quantifiable yet. In other words, I was interested primarily in what happened in the numbers across these companies that’d led to their respective multi-fold upsurges within the span of just 12 months. Qualitative considerations were important too in building my roadmap for finding fundamental-driven long ideas, but I view them as secondary, though critically complementary, to quantitative commonalities observed.

Across the 500+ stocks listed on the NYSE and Nasdaq that had multi-bagged in either 2023, 2024 or in both of those years, my research narrowed down those within the technology sector. There were 96 technology sector stocks listed on the NYSE and Nasdaq that had multi-bagged in either 2023, 2024 or in both of those years.

While it’s impossible to pinpoint an exact “one size fits all” mathematical formula that can absolutely dictate the next set of tech multi-baggers, one thing was for sure coming out of my research work – investors’ appetite had structurally shifted from a short stint of “growth at all costs” during the non-sustainable post-COVID stimulus and 0% financing cost appreciation cycle, to a preference for “earnings or bust” set-ups that have shown relative resilience against evolving market dynamics.

Essentially, from a fundamental perspective alone, valuations have been screaming “earnings is king” in the past two years.

As a result of my research and analysis work, I’ve curated the following roadmap to guide my methodology in building a portfolio of fundamental-driven long ideas. It’ll dive specifically into what my research entails; findings and observations; the summary of fundamental trends and commonalities observed across the tech multi-baggers; and how I’ve curated a selection filter for my upcoming portfolio of fundamental-driven long ideas, which I’ll also be sharing with you soon.

My Research and Analysis Method

As mentioned in the earlier section, there were 500+ names across the NYSE and Nasdaq that multi-bagged in either 2023, 2024 or in both of those years:

Since my focus is to find tech-focused fundamental-driven long ideas, I’d filtered the population of multi-baggers observed across 2023 and 2024 to include only those within the technology sector. There were 96 technology sector tickers across the NYSE and Nasdaq that had multi-bagged in either 2023, 2024 or in both of those years:

Unsurprisingly, the technology sector was one of the major contributors to multi-baggers observed in each of 2023 and 2024. It was also the leading contributor of stocks that had multi-bagged in both of 2023 and 2024:

A high-level explanation for the technology sector’s leading contribution to multi-baggers observed in 2023 and 2024 is due to the constituents’ higher-growth nature and inherently elevated scalability that have typically yielded generous profit margins (e.g., software industry). Why these might represent leading indicators of value appreciation prospects is discussed in later sections. The observation also explains why the Nasdaq exchange delivers more multi-baggers compared to the NYSE, given constituents in the latter exchange are typically in the mature/stable stage of the business cycle and/or partake in capital-intensive industries with inherently slim profit margins.

After I’d determined the set of technology sector multi-baggers in each of 2023 and 2024, I proceeded to curate a list of quantitative and qualitative considerations that I believe to be critical for fundamental-driven long ideas. And I will be assessing said factors across each of the tech multi-baggers observed in 2023 and 2024 to determine what matters most.

Quantitative Factors – It was important that I started looking at fundamentals in the year before and after each of the stocks had multi-bagged to get a full picture of whether retrospective or forward (or both) performance was the driver of multi-fold upsurges. This meant digging back to and assessing the actual fundamental performance of the 2023-2024 technology sector multi-baggers in calendar years 2022 through 2024, as well as considering the 2025 estimates. The following are a list of four critical fundamental components I’ve assessed:

Revenue growth: Investors typically prioritize companies that demonstrate sustainable robust growth, as this represents organic scalability from the underlying business. Organic scalability is an especially critical consideration when assessing tech companies, as the majority still remains in the start-up and growth phases of the business cycle, and only those that can scale will generate value. Scalability also reflects their ability to expand operations efficiently, which propels sustained margin expansion and cash flows growth critical for value appreciation.

Earnings growth: In addition to scalability, operational optimization is another critical factor for start-ups and growth-stage businesses in particular. And earnings growth represents a key indicator of these two components’ progress. When earnings growth is considered in combination with revenue growth, it also reveals margin expansion or compression dynamics, offering insights into whether the company’s business model and strategy enhances or undermines the fundamental outlook that underpins valuations.

Cash: Examining changes in cash balances provides critical insights into how well the organic operational cash burn run-rate is being managed at growing tech companies (i.e., excluding the impact of mergers and acquisitions and/or financing activities). Beyond revenue and earnings growth, changes in a company’s cash balance also reveal which part of the broader business cycle it’s in (i.e., start-up, growth, maturity or decline), and the self-sustainability and scalability of operations, which are key drivers of value appreciation. Most importantly, analyzing cash alongside capital expenditure (“capex”) is a key telling tale that answers one of the most critical questions in valuation: Is return on investment (“ROI”) expanding to support sustainable growth and efficiency?

Capex: Capex represents a critical cash outflow that, like changes in cash balances, indicates a company’s position in its business cycle (e.g., investment vs. monetization stage). It provides deeper insights into whether revenue and earnings growth are sustainable and scalable because of investments deployed back into the organic business, or because of costly merger and acquisition (“M&A”) activities instead to artificially boost expansion. The latter scenario (i.e., M&A activities) plays a lesser role in determining the next fundamental-driven multi-bagger if it isn’t considered in concurrence with a positively quantifiable synergy. The consideration eventually leads back to whether the company’s capex strategy can help the organic business scale and optimize more efficiently to benefit cash flows underpinning valuations.

Qualitative Factors – In addition to quantitative factors, I’ve also determined a set of qualitative factors that play a critical role in dictating fundamental-driven value appreciation prospects. I categorize these qualitative factors into two groups based on their respective impact (i.e., direct vs. supplementary) on quantitative consideration factors discussed in the earlier section – namely, 1) direct qualitative considerations, and 2) supplementary qualitative considerations. The qualitative factors I consider in conjunction with the primary quantitative factors listed above include the following:

Changes in leadership or governance: This includes a change in CEO and/or an overhaul of the board composition (e.g., addition of an activist board member). I consider these changes as direct qualitative considerations given their far-reaching impact on a company’s organic top- and bottom-line growth trajectory. Typically, changes in management aim to either reverse the sins of the past or push the company into overdrive to advance to the next phase of the broader business cycle. And either way, it’s bound to result in changes to the company’s business plan, which would inadvertently levy a direct impact on its fundamental trajectory and valuation outcome.

New product release: Another key direct qualitative consideration is whether the company had introduced new product(s) in the year leading up to, of, or after its stock had multi-bagged. This is because new product releases typically have a direct impact on a company’s organic top- and bottom-line growth. Sometimes, the new product launch might become additive to a company’s growth outlook, given it unlocks a new total addressable market (“TAM”) or serviceable addressable market (“SAM”) for the business. In other times, there have been scenarios where a new product launch alters the fundamental direction of the company (e.g., from cost-heavy research and development to monetization-heavy go-to-market), which is typical across capital-intensive tech industries today, including electric vehicles (“EV”), autonomous mobility (“AV”) and robotics.

Changes in business model/go-to-market (“GTM”) strategy: A change in the business model typically coincides with new management installations and/or new product releases, and levies a direct impact on a company’s top- and bottom-line growth prospects. For instance, if a company switches from a SaaS business model to a consumption-driven business model, the determinants of its key quantitative factors become significantly altered as growth and earnings considerations can be drastically different between the two strategies. A change in the GTM strategy can also yield a similar direct impact on a company’s fundamental outlook. Take Palantir Technologies Inc for example. The company’s deployment of its legacy Foundry and Gotham operating systems used to be a very company-specific sales endeavour. But since its launch of the Artificial Intelligence Platform (“AIP”) product in 2023, Palantir has primarily relied on “AIP Bootcamps” to land new and expand existing businesses in bulk and with speed. This has essentially been a significant transformation to Palantir’s GTM strategy that’s unlocked huge sales and market cost-savings and enabled substantial improvements to the scalability of its business, effectively altering the trajectory of its pace of earnings expansion in recent years.

M&A activities – Unlike catalyst-driven trade ideas, which would typically consider potential post-M&A synergies that might not yet immediately be quantifiable, I wanted my fundamental-driven long ideas to be founded strictly based on organic company performance factors. As a result, M&A activities are considered a supplementary qualitative consideration that must be contemplated alongside the post-integration quantitative trajectory in determining their fundamental weight in creating multi-baggers.

Changes in regulation, competitive dynamics, and the secular demand environment: These qualitative factors are usually key drivers of catalyst-driven shocks to stock valuations due to their typically speculative nature. But sometimes, they can also underpin sustained re-rates in valuation, primarily when said qualitative factors can be supplemental to a tangibly quantifiable impact on the underlying business’ growth trajectory. As a result, I consider these indirect qualitative factors when analyzing the potential key drivers of past multi-baggers in the tech sector. In these circumstances, I consider whether the related qualitative changes in consideration have been accommodative and/or additive to a company’s quantifiable fundamental trajectory. This would determine the extent of which the said qualitative factors have contributed to the multi-fold value appreciation of past multi-baggers in the tech sector, and whether they’re important factors to consider when curating my portfolio of fundamental-driven long trade ideas.

Observations

73 out of the 96 tech-sector multi-baggers (76%) observed in each of 2023 and 2024 have demonstrated a direct correlation to significant improvements in the quantitative consideration factors discussed in the earlier section. This cohort will be referred to as “fundamental-driven multi-baggers”. And 46 of them were complemented by adjacent qualitative indicators discussed in the earlier section. See Exhibit 1.

23 of the 96 tech-sector multi-baggers (24%) observed in each of 2023 and 2024 are considered “anomalies” that’ve demonstrated weak correlation to tangibly quantifiable fundamental factors, and have instead shown a strong link to speculative qualitative factors.

Quantitative Considerations

See Exhibit 2.

Recently Turned Profitable

Having recently become profitable was a key commonality across the 73 fundamental-driven multi-baggers in each of 2023 and 2024. Of the 73 fundamental-driven multi-baggers, 40 of the companies (55%) had just recently turned profitable in either 2023 or 2024, or is in process of becoming profitable in 2025.

And 31 of these had multi-bagged in the same year they’d turned profitable. 14 of which also showed significant value appreciation in the year leading up their earnings transition, and four of which continued to show significant value appreciation in the year following the switch to profitability. 13 of which demonstrated significant value appreciation only in the same year in which it turned profitable. See Exhibit 3.

Multi-Fold Annual Earnings Growth

55 of the 73 fundamental-driven multi-baggers (75%) demonstrated multi-fold annual earnings growth in either 2023 or 2024, and/or is estimated to deliver multi-fold annual earnings growth in 2025. Every company that had turned profitable recently, as discussed in the earlier section, had also demonstrated multi-fold earnings growth in the same year. 15 companies that had delivered multi-fold annual earnings growth did not demonstrate a switch from annual losses to profitability in 2023 nor 2024, as they were already profitable. This implies that profitability is a key prerequisite for multi-baggers.

43 of said 55 companies had multi-bagged in the same year they delivered multi-fold earnings growth. 15 of which also showed significant value appreciation in the year leading up to the multi-fold annual earnings growth, and four of which continued to show significant value appreciation in the year following the delivery of multi-fold annual earnings growth. 24 of which demonstrated significant value appreciation only in the same year in which it delivered multi-fold annual earnings growth. See Exhibit 4.

Significant Revenue Acceleration

18 of the 73 fundamental-driven multi-baggers (25%) showed no shift from annual losses to profitability, nor did they deliver annual multi-fold earnings growth in 2023 or 2024. They are also not expected to shift from annual losses to profitability, nor deliver annual multi-fold earnings growth in 2025.

Instead, these 18 companies demonstrated significant annual revenue acceleration in 2023, 2024, or both 2023 and 2024. Some are also expected to deliver significant annual revenue acceleration in 2025. More than half have or are expected to deliver year-on-year revenue growth of 100%+.

Significant revenue acceleration is not a must-have quantitative indicator in the 55 multi-baggers that’ve demonstrated (or is expected to demonstrate) multi-fold annual earnings growth. But significant revenue acceleration has shown itself as a key marker across multi-baggers that did not deliver multi-fold annual earnings growth. See Exhibit 5.

Qualitative Considerations

The data showed that new product launch represents a key common qualitative indicator across the 73 fundamental-driven multi-baggers observed. 40 of the 73 fundamental-driven multi-baggers (55%) had a new product launch in either 2023, 2024, both 2023 and 2024, or coming 2025. See Exhibit 6.

17 of which had launched a new product in one of 2022, 2023 or 2024, or in all of the three preceding years without correspondence with new external financing arrangements, M&A activities, management and/or governance transition, nor implementation of a new business model. Meanwhile, 23 of the fundamental-driven multi-baggers that had launched a new product during the data set period had done it alongside access to new financing arrangements, M&A activities, executive management transition, and/or the implementation of a new business model. Specifically, 8 of the 23 had coincided with new financing undertaken through a securities issuance and/or bank borrowings in one of the preceding three years, and 9 had coincided with both M&A activities and new financing acquired within the same period.

Exchange Considerations

As discussed in the earlier section, the tech- and growth-heavy Nasdaq has delivered more multi-baggers than the NYSE did in each of 2023 and 2024.

19 of the 73 assessed fundamental-driven multi-baggers (26%) were listed on the NYSE. The data shows that seven of them had shown significant value appreciation in the year leading up to the underlying business’ delivery of critical fundamental improvements (e.g., significant revenue acceleration; transition to profitability; multi-fold annual earnings growth). This is likely due to the fact that companies listed on the NYSE are typically viewed by investors as more mature and stable, which is corroborated by the fact that the exchange has consistently outperformed broader markets during times of elevated volatility. The observation accordingly increases confidence and visibility into the reliability of forward fundamental projections, hence potentially explaining why NYSE-listed fundamental-driven tech multi-baggers have typically appreciated by multi-fold in the year leading up to their underlying business’ delivery of critical fundamental improvements versus in the year of.

There were another seven NYSE multi-baggers that had shown significant value appreciation in the same year that their underlying businesses had delivered critical fundamental improvements. Three of the NYSE-listed fundamental-driven tech multi-baggers started delivering significant value appreciation in both the year before and the year of their respective critical fundamental improvements, which aligns with the earlier discussion that there tends to be greater investor confidence in NYSE estimates. Two of the NYSE-listed fundamental-driven tech multi-baggers extended their significant value appreciation in the year after they’d delivered the critical fundamental improvements. See Exhibit 7.

Meanwhile, 54 of the 73 assessed fundamental-driven multi-baggers (74%) were listed on Nasdaq. Unlike the fundamental-driven tech multi-baggers observed in the NYSE, those listed on the Nasdaq had primarily (23 of them) shown significant value appreciation in the same year they’d delivered critical fundamental improvements. This is likely because Nasdaq-listed stocks have historically been more volatile than broader market performance, leading investors to prefer action-taking when there’s greater evidence supportive of value appreciation opportunities (e.g., responsive valuation upsurges after periodic earnings outperformance on Nasdaq vs. pre-emptive valuation upsurges prior to periodic earnings outperformance on the NYSE).

15 showed significant value appreciation in the year before and in the same year they’d delivered their critical fundamental improvements. Only 12 showed significant value appreciation only in the year leading up to their delivery of critical fundamental improvements. Three showed significant value appreciation in the same year and the year after they’d delivered their critical fundamental improvements. And one showed significant value appreciation only in the year after they’d deliver critical fundamental improvements. See Exhibit 8.

Anomalies

There have been 23 tech multi-baggers observed in each of 2023 and 2024, or in both 2023 and 2024 that’ve shown limited correlation to the critical fundamental improvements (e.g., shift from annual losses to profitability; multi-fold annual earnings growth; significant revenue acceleration). See Exhibit 9.

21 of which (91%) have demonstrated significant correlation and sensitivity to one of the following key market themes since 2023: artificial intelligence, quantum, crypto, autonomous mobility, and China.

Artificial Intelligence (“AI”): Nine of the anomalies have demonstrated direct participation in AI opportunities, whether it’s directly through AI product launches (e.g., infrastructure hardware; foundation large language models; end-user AI applications) or indirectly through the supply of data and data management solutions.

Quantum: Five of the anomalies have demonstrated direct participation in the quantum rally that began in late 2024. This coincided with Alphabet Inc’s introduction of its first “Willow” quantum chip, which demonstrated capabilities in solving complex problems that should’ve taken longer than the universe’s lifetime in under five minutes. Yet this quantum rally was short-lived and mostly fizzled in early 2025 when NVIDIA Corp CEO Jensen Huang estimated that quantum computing will not have useful mass market use cases for at least another two decades. This announcement pretty much solidified concerns that the upsurge lacked durability given limited quantifiable fundamental support. The five quantum-related multi-bagging anomalies in 2024 have lost at least -43% of their respective values in the first two months of 2025 (average -60% YTD declines as of February 28, 2025).

Crypto: Three of the anomalies have direct participation in the crypto industry. Crypto names have demonstrated significant volatility in recent years, given their inherently elevated sensitivity to macroeconomic conditions amidst the monetary tightening cycle in recent years, as well as changes to the regulatory environment (e.g., in anticipation of BTC spot ETF approvals in January 2024; impending regulatory clarity for crypto assets under new Trump administration in late 2024). Yet the majority of these stocks have demonstrated limited correlation to tangible fundamental improvements, given nominal monetizable use cases in the mass market for cryptocurrency. Two of the three crypto-related multi-baggers observed in each of 2023 and 2024 have declined by more than 30% from their respective year-end peaks within one week. Only Strategy (formerly MicroStrategy Inc) has maintained its multi-fold gains since 2023, through it’s primarily due to Bitcoin accumulation funded through external financing rather than organic fundamental business growth.

Autonomous mobility: Two of the anomalies have direct participation in the reemergence of the autonomous mobility theme following the new Trump administration’s promise to prioritize the related regulatory framework for public rollouts. However, since the anticipated improvements to regulatory clarity remain uncertain, there’s still limited visibility into the timing and size of which autonomous mobility opportunities will materialize. This has accordingly resulted in weaknesses to the durability of related upsurges, which is consistent with the approximate average decline of -34% over the first two months of 2025 (i.e., since the related multi-bagger anomalies’ respective peaks in late 2024 to date).

China: Two of the anomalies are China American depository receipts (“ADRs”) listed on Nasdaq, which demonstrated sudden, yet non-sustainable, upsurges that coincided with favourable changes in central government policies. One of the names that’d multi-bagged in early 2023 surged amidst China’s post-pandemic reopening rally, while its US counterparts struggled with one of the most aggressive monetary policy tightening cycles in four decades. The other name that’d multi-bagged in late 2024 surged in response to Beijing’s improving policy support for the local economy at the time, as well as the announcement of a planned acquisition; it’s also been a key beneficiary of the emerging Chinese AI rally unleashed by DeepSeek’s breakthrough efficiency revelations. Yet both anomalies have demonstrated limited improvements to critical fundamental considerations discussed in the earlier sections.

The sharp positive response to favourable policy changes, although not yet fundamentally quantifiable, is likely reflective of Chinese ADRs’ inherently significant discount on a relative basis to comparable American counterparts due to the China risk premium driven by regulatory, geopolitical and macroeconomic uncertainties. This accordingly leaves a generous margin for multiple expansion in response to qualitative factors that may be supportive of reducing the China risk premium. However, related value appreciation have typically shown lacking durability due to limited evidence of tangible fundamental improvements.

Pintec Technology Holdings Limited, which multi-bagged in 2023, acquired most of its gains in the first four months of the year, which coincided with China’s post-pandemic reopening rally. It then pared the gains by as much as 95% within just one month from the YTD peak reached in April 2023, and ended the full year with a 172%+ appreciation instead. Meanwhile, iClick Interactive Asia Group Limited, which multi-bagged in 2024, acquired most of its gains in the last two months of the year, which coincided with Beijing’s slew of economic support announced since, as well as its planned acquisition of digital wealth management services firm Amber DWM Holding Limited. Neither stocks have demonstrated significant organic fundamental improvements in the underlying business to match their qualitative-driven momentum.

There are two other anomalies that have demonstrated key qualitative considerations – namely, a new CEO installation (i.e., leadership/governance change) and a new product launch – in the year corresponding to their respective multi-bagging journeys. Although they did not coincide with critical fundamental improvements (e.g., a shift from annual losses to profitability; multi-fold annual earnings growth; significant revenue acceleration), both companies have shown consistent earnings expansion from 2022 through 2024, which is indicative of scalability and optimization – two critical business components as discussed in the earlier sections.

Based on my assessment of the anomalies and potential drivers of their multi-fold value appreciations, the majority of which have been sudden and short-lived shocks. As a result, these are akin to catalyst-driven trades, in my opinion, which are typically reflective of re-rates driven by qualitative factors that are not immediately quantifiable yet, leaving little fundamental support required for a sustained valuation appreciation. I aim to explore further on drivers of catalytic trade ideas in a future analysis.

Control Group Analysis

I’ve also assessed names that exhibited critical fundamental improvements (e.g., multi-fold revenue acceleration; multi-fold earnings growth; transition from annual losses to profitability) in 2023 and/or 2024, and/or are expected to deliver said characteristics in 2025, yet did not multi-bag in 2023 nor 2024. This procedure was performed to determine any other quantitative and/or qualitative weaknesses present that could’ve offset the positive impact of critical fundamental improvements on valuations.

The key takeaway was that GAAP-based profitability was a key prerequisite for significant value appreciation. This compares to an earnings transition marked by publicly available EPS data, which typically includes non-GAAP adjustments. Another key consideration is that the presence of critical fundamental improvements (e.g., multi-fold revenue acceleration; multi-fold earnings growth; earnings transition) must be sustainable. In other words, the critical fundamental improvements must not reverse in the following period (e.g., revert to annual losses and/or significant revenue deceleration) or be driven by one-time events (e.g., M&A activities); any signs of slashed guidance from management would also represent a downside risk to value appreciation prospects. This accordingly reflects the mission-critical role of organic scalability and optimization in the underlying business for sustainable fundamental-driven value appreciation.

The below section will provide further details on observations in the control group analysis:

Nasdaq

Multi-Fold Revenue Appreciation

In the Nasdaq exchange, there were four names that delivered multi-fold revenue growth in 2023, and one name that is expected to deliver multi-fold revenue growth in 2025. Yet none of the five names have delivered significant value appreciation in 2023 nor 2024.

Two of the names demonstrated multi-fold revenue appreciation in 2023 due to full-year integration of newly acquired companies. As discussed in the earlier section, M&A-related changes in fundamental trajectory aren’t considered characteristics of organic scalability and/or optimization. This likely explains the absence of accompanying multi-bag value appreciation at the two names.

Two of the other names that demonstrated multi-fold revenue growth in 2023 remain unprofitable. Based on my assessment of 2023 and 2024 tech multi-baggers in the earlier section, it appears that profitability is a key prerequisite for significant value appreciation. This is consistent with expectations that tangible cash flow accretion at a profitable company is a key driver of sustained value appreciation.

The fifth name is expected to deliver significant revenue growth in 2025 (Nebius Group NV). As discussed in the “Exchange Considerations” section, valuation changes in Nasdaq-listed names are typically responsive rather than pre-emptive to earnings results. The company is also not yet profitable, nor is it expected to turn profitable in 2025. Hence this could explain why the stock has yet to deliver significant value appreciation.

Multi-Fold Earnings Growth and/or Earnings Transition

There were 47 tech names on Nasdaq that exhibited multi-fold earnings growth and/or transitioned from annual losses to profitability in 2023, yet were not accompanied by significant value appreciation in 2023 nor 2024. 23 of these names have or are expected to backtrack into earnings declines or losses post-2023, which contradicts the requirement for organic scalability and optimization to underpin sustained value appreciation. And 15 of these names delivered net ~25% value appreciation in 2023 and 2024. 13 of which had delivered more than 50% appreciation in 2023, which is the same year they delivered multi-fold earnings growth, before paring gains in 2024. Although they did not multi-bag, the net 25%+ appreciation through 2023 to 2024 is a threshold I consider as reflective of the reward for their partial fundamental improvements.

This leaves nine anomalies to be further assessed. A deeper dive shows that five of them weren’t profitable on a GAAP basis (recall that the data assessed includes non-GAAP EPS metrics), which contradicts a key prerequisite for multi-fold value appreciation. Three of the nine anomalies also slashed key earnings and growth expectations for full-year 2024, which likely impacted their value appreciation prospects as well. One of the anomalies was a Chinese online recruitment business, which suffered significantly from China macroeconomic weakness and consistent underperformance in estimates; this accordingly increased uncertainties to the scalability of the underlying business. And one of the anomalies (First Solar Inc) had actually multi-bagged in 2022 in anticipation of its earnings transition achieved in 2023.

Meanwhile, 28 names listed on Nasdaq exhibited multi-fold earnings growth in 2024, but did not deliver significant value appreciation in 2023 nor 2024. 24 of the names delivered net ~25% growth in 2023 and 2024; 16 of which delivered 50%+ value appreciation in 2024. Three of the names are expected to return to earnings declines in 2025, indicating the lack of scalability in the underlying business, which is another key prerequisite for value appreciation.

This leaves one anomaly to be further assessed – namely, Ultra Clean Holdings Inc (“UCTT”), which is a critical solutions provider to the semiconductor industry. The company delivered multi-fold EPS growth in 2024 and is GAAP profitable. Yet the stock’s modest ~20% value appreciation observed in 2024 is likely a reflection of market’s concerns about the company’s exposure to tightening semiconductor export curbs – especially at its China business. The company generated 73% of its sales outside of the US in 2024, with management citing China as a primary revenue contributor. This accordingly raises uncertainties about UCTT’s revenue outlook, and inadvertently introduces downside risks to the durability of its earnings critical to supporting the stock’s valuation.

NYSE

Multi-Fold Revenue Appreciation

Recall that NYSE multi-baggers typically exhibit significant value appreciation in the year leading up to their respective critical fundamental improvement(s). Yet there was one name (GCT Semiconductor Holding Inc / “GCTS”) listed on the NYSE that did not deliver significant value appreciation in 2024, despite expectations for multi-fold earnings growth in 2025. And similar to observations in non-multi-baggers on the Nasdaq discussed in the earlier section, GCTS’ underperformance in 2024 is likely the result of its ongoing GAAP losses, despite expectations for impending multi-fold earnings growth.

A deeper dive into the company’s 2024 fundamentals also reveals that it’d benefitted from a de-SPAC (i.e., catalyst-driven) upsurge earlier in the year. This was coupled with a transition to GAAP profitability in 1Q24. However, the earnings transition was not sustainable, as it was the result of a one-time $14.6 million benefit to the bottom-line resulting from gains realized on the extinguishment of a liability tied to its development agreement with Samsung.

Multi-Fold Earnings Growth and/or Earnings Transition

23 NYSE-listed tech stocks that exhibited multi-fold earnings growth in 2023 did not deliver significant appreciation in 2022 nor 2023. Six of them were expecting earnings deterioration in 2024, with one other also expected to revert back to annual losses. One of them was also not GAAP profitable. These are indicators of lacking organic scalability in the underlying business, which likely explains the affected stocks’ limited value appreciation observed through 2022, 2023 and 2024.

Meanwhile, 18 of the said 23 names had either demonstrated more than net ~25% value appreciation between 2022 and 2023 or between 2023 and 2024; eight of which delivered more than 50% annual value appreciation in either 2023 or 2024. The outperformance against broader markets implies that they were still rewarded for their partial earnings improvements, despite not having multi-folded in value.

This leaves five anomalies to be further assessed. Three of which either did or were close to multi-bagging in 2023 in anticipation of their respective earnings transitions before paring gains due to slashed guidance. And two of the names faced significant deceleration from 2022 alongside repeated earnings underperformance, which likely led to a downward adjustment in valuation considerations given concerns about the durability of their respective earnings transitions.

Meanwhile, 57 NYSE-listed tech names exhibited multi-fold earnings growth in 2024, yet did not multi-bag in valuation in 2023 nor 2024. However, most (30) had demonstrated strong value appreciation in the preceding year, resulting in net gains of more than 25% in the two years through 2024; 17 of which delivered value appreciation of more than 50% in either 2023 or 2024.

In the remaining 27 names, three of which are expected to return to annual losses in 2025, and six face impending earnings declines. Five others were explained as part of the 2023 anomalies in the earlier section.

This leaves 13 anomalies to be further assessed. 10 of which were not actually GAAP profitable, despite positive EPS data assessed that likely included non-GAAP adjustments.

For the remaining three names, one of them (Teradata Corp) did not actually deliver multi-fold earnings growth on a GAAP basis, with the underlying business also facing multiple downward revisions to both 2024 and 2025 estimates alongside recurring revenue declines, thus raising further weakness in earnings and value accretion prospects.

Another name (HUYA Inc – ADR / “HUYA”) that’d delivered multi-fold earnings growth and a transition to annual profitability also had its bottom-line improvements overshadowed by persistent revenue declines. Specifically, HUYA’s multi-fold earnings growth was primarily realized from significant cost-savings resulting from a pivot in its business model to prioritize higher-margin revenue streams. However, those growth avenues face impending secular declines, which are worsened by HUYA’s significant revenue exposure to China’s mixed macroeconomic backdrop, harbingering inevitable earnings deterioration risks.

The final anomaly (Tuya Inc / “TUYA”) that’d delivered multi-fold earnings growth in 2024 but did not multi-bag in 2023 nor 2024 has actually delivered multi-fold value appreciation in early 2025. The delayed appreciation was likely due to the added tailwind of China’s improving policy backdrop in recent months, which alleviated some of the region-specific risk premium that’s been weighing on the Chinese ADR’s valuation. This has also likely bolstered the durability of TUYA’s underlying business performance and reinforced market confidence in its fundamental-driven upside potential. The company will remain on my watchlist for further fundamental-driven value appreciation prospects in the current year.

Summary of Key Commonalities that Underpin Tech Multi-Baggers in 2023 and 2024

The following ranks key commonalities observed across the 73 fundamental-driven tech multi-baggers by importance:

1. Earnings is king – The shift from annual losses to profitability, as well as multi-fold annual earnings growth is the number one common driver observed across the 73 fundamental-driven tech multi-baggers in the assessed data set. This is likely because it’s an indicator of sustained margin expansion and profitable growth, as product/services sales continue to scale. It’s essentially a marker of change in the broader business cycle, from start-up investment phase to growth monetization phase. And this accumulation of underlying free cash flows driven by sustained improvements in operating leverage represent a critical driver of future value appreciation prospects.

2. Significant revenue acceleration – The 18 fundamental-driven tech multi-baggers observed in each of 2023 and 2024, or in both 2023 and 2024 that did not deliver a shift from annual losses to profitability nor multi-fold annual earnings growth had instead demonstrated significant annual revenue acceleration. More than half had exhibited or are expected to exhibit multi-fold annual revenue growth, with the remaining six demonstrating growth acceleration at an annual rate of at least +11% y/y (average annual rate +20% y/y). This observation is also consistent with the importance of scalability and the characteristic’s impact on profit margins critical for value accretion.

3. New product launch – This has emerged as a leading qualitative factor that’s directly supplementary to critical quantitative factor improvements, such as significant revenue acceleration and/or multi-fold annual earnings growth. As discussed in an earlier section, new product launches that are additive to growth and/or enabling TAM expansion can underpin significant valuation re-rates, which can sometimes result in multi-baggers like those within the assessed data set.

Filter and Selection Process

I aim to leverage the findings from my screener of 2023/2024 tech multi-baggers discussed in the foregoing analysis to underpin the construction of my fundamental-driven long trade ideas portfolio this year. This portfolio will consist of a maximum of 10 names.

Initial Fundamental Shortlist

I will first curate a new data set that consists of the critical fundamental factors across the population of technology sector names listed on the NYSE and Nasdaq. These critical fundamental factors include revenue growth, earnings growth, period-end cash balance and capex for 2025 and 2026. The 2025-2026 assessment timeline is consistent with my goal of finding fundamental-driven long trade ideas with optimal upside potential in the current year, which, based on findings in my foregoing analysis, is typically dependent on fundamental estimates in the next 12 to 24 months (i.e., current and following calendar year).

Consistent with my findings listed in the “Summary of Key Commonalities…” section, tech sector constituents that demonstrate prospects of multi-fold earnings growth while already GAAP profitable, first-year profit recognition, and/or multi-fold revenue growth acceleration in 2025 and/or 2026 will be considered.

This shortlist will be further refined based on observations discussed in the “Exchange Considerations” section. Specifically, Nasdaq-listed candidates that are expected to deliver critical fundamental factors in the current year, and NYSE-listed candidates that are expected to deliver critical fundamental factors in the following year will be included in the initial shortlist.

Qualitative Considerations

The next step is to further refine the initial shortlist by performing a preliminary qualitative analysis on each of the selected names. This is done by screening the latest periodic filings (annual and/or quarterly reports) and the most recent earnings transcript for the complementary qualitative markers assessed in my retrospective analysis of fundamental tech multi-baggers in 2023/2024. These include announcements of a recent/upcoming product launch, new CEO installation and/or leadership and governance changes, and/or the adoption of a refined go-to-market strategy, which are complementary qualitative factors that could be indicative of additive growth and/or margin expansion.

The initially shortlisted names that also demonstrate one or more of the said complementary qualitative factors will be further prioritized. And names that are expecting an impending fundamental uplift (e.g., multi-fold earnings and/or earnings growth) within the next 12 to 24 months due to inorganic measures (e.g., M&A activities) will be removed from the shortlist.

I will also be on the lookout for downward adjustments to management guidance exhibited at names that are expected to deliver critical quantitative fundamental improvements. This is consistent with observations in the “Control Group Analysis” section, which identifies those with consistent earnings underperformance as multi-bag misses – even if they’re expected to deliver multi-fold revenue acceleration, multi-fold earnings growth, and/or a transition from annual losses to profitability.

Fundamental Deep Dive

The shortlist refined by quantitative and qualitative considerations will be subject to a fundamental deep dive, which is a two-step process that will first determine the durability of financial estimates and projections, then assess the estimated intrinsic value of the company.

i. Determine the durability of financial estimates – This primarily entails learning the shortlisted company’s business in detail to confirm the durability of fundamental estimates over the next 12 to 24 months that were assessed earlier on. This step should refine my fundamental long tech shortlist to no more than 20 names.

The purpose is to determine whether the projected earnings growth, transition to annual profitability, and/or significant revenue acceleration can be sustainably achieved through organic optimization and scalability of product/services sales. Any indications of one-time drivers (e.g., one-time contract recognitions, pulled-forward demand) would suggest that the critical fundamental consideration factor is non-sustainable and unlikely to translate into significant value appreciation; these names will be eliminated from my shortlist.

This step will also help with determining the company’s TAM, where exactly it’s at in capitalizing on related opportunities, and whether it has the means to optimize participation in the said growth opportunity. Is the company shifting from start-up (i.e., investing cycle) to growth (i.e., monetization cycle) phase of the broader business cycle at a time where significant opportunities persist in the industry? Does the company have a unique competitive advantage that can help it better navigate through the rapidly evolving business dynamics (e.g., cyclical headwinds, competition)?

The last thing you’d want is to invest into a company that’s readying to ship a new, yet inferior, product into an industry that’s already concentrated with much more superior competitors. It’s essentially a recipe for ROI Armageddon, since intensive investment outlays deployed are now met with limited monetization prospects. A prime example of which would be Intel Corp, which shipped its “Sapphire Rapids” Xeon server CPUs late into a cyclical slowdown in 2023, causing it to lose significant market share to rival Advanced Micro Devices Inc; it’d go on to repeat the same mistake by shipping an inferior Gaudi 3 accelerator in 2024, which pretty much cost Intel’s entire participation in the ongoing AI/data center boom.

This refinement process also means that the names with the highest percentage of estimated earnings increase and/or revenue increase in the NTM doesn’t automatically translate into increased confidence in its multi-bag prospect by default.

For example, consider company A, which is expected to increase earnings by 150% in 2025, and company B at 125%. They both meet the shortlist criteria of multi-fold earnings growth. Yet company A’s higher estimated rate of earnings growth doesn’t automatically mean it has a better chance of multi-bagging than company B. While company A’s higher level of earnings increase does give it a higher 50-percentage point margin for adjustments to stay compliant with the multi-fold earnings growth criterion, its prospects of becoming a multi-bagger could also depend on the estimate’s source (organic vs. M&A) and durability (scale and optimization vs. one-time cost benefits). For instance, if half of company A’s estimated earnings growth in the NTM is due to a recent acquisition, then company B would be the better pick given its value appreciation prospects are based on organic fundamental improvements. The only way to find out which is indeed the stronger candidate in becoming a multi-bagger is through the fundamental deep dive refinement process.

ii. Financial model the estimated intrinsic value (price determination) – After the financial elements check out (e.g., the critical fundamental considerations are sustained by organic scalability/optimization; significant industry growth runway; unique competitive advantages present), the final step would be to determine their estimated intrinsic value (i.e., price target). This will be key in guiding the entry and exit points for the selected fundamental-driven long trade idea.

I prefer to use the discounted cash flow (“DCF”) method, as all shortlisted names should be either approaching or are already profitable and cash flow positive. The DCF method would yield a valuation that is better reflective of the intrinsic value of underlying business cash flows prospects. Key assumptions considered in performing the DCF analysis include revenue and earnings growth estimates, which flow directly into the assessed cash flow projections; cost of capital considerations; and the terminal value.

The cash flow estimates will be determined primarily based on historical trends in revenue growth and earnings margins, as well as forward adjustments considering factors including, but not limited to, management guidance, new product launches, and changes in demand dynamics.

Cost of capital assumptions will primarily relate to the company’s capital structure (debt vs. equity) and risk profile (e.g., cost of debt vs. risk-free rate).

And the terminal value will be computed based on the application of an estimated perpetual growth rate on terminal-year cash flows. Terminal-year cash flows is proxied by projected EBITDA in the final year of the forecast period when the underlying business’ growth is expected to have reached steady-state. The estimated perpetual growth rate will mirror the projected pace of economic expansion across the company’s core operating region(s), which aligns with the rate of which steady-state cash flows can grow sustainably into perpetuity.

In some cases, the estimated intrinsic value computed under the DCF analysis can be supplemented by an estimated relative-basis value computed under the multiple-based approach. This combined valuation method can sometimes help to better gauge the shortlisted stock’s upside potential.

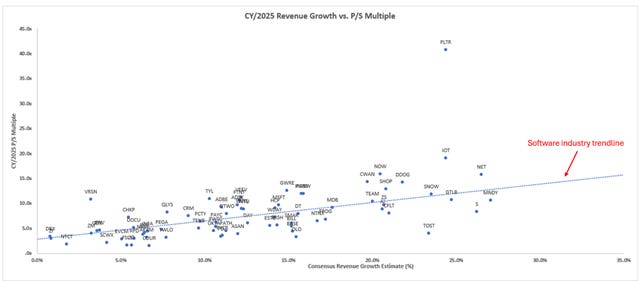

The multiple-based valuation approach would entail mapping stocks across a comparable industry (e.g., software) based on their earnings/revenue growth estimates against their respective P/E and/or P/S multiples. Each stock’s placement on the chart would be compared to the average regression trend line, as well as multiples exhibited by peers with a comparable growth prospect to determine its premium/discount on a relative basis. Below is an example of software industry price-to-sales multiples mapped against their respective NTM revenue growth based on Wall Street estimates as of calendar year-end 2024:

I’d utilize this combined valuation approach that considers both the DCF and multiple-based outcomes in scenarios where risks of confirmation bias are elevated (e.g., AI names have better growth acceleration prospects) and/or underlying cash flow projections are not yet reflective of the impending re-rate (e.g., a company that’s approaching profitability is not yet trading at the extended multiple of a comparable peer that already exhibits a positive bottom-line).

The top 10 names that demonstrate the highest level of durability in impending critical fundamental considerations (e.g., multi-fold earnings outlook; transition from annual losses to profit; multi-fold revenue acceleration) and complementary qualitative environment (e.g., new product launch), alongside the best price-to-value set-up will be added to my basket of fundamental-driven long trade ideas.

Names that are constituents within the Nasdaq 100 and/or S&P 500 will also be preferred. This is because the Nasdaq 100 and S&P 500 are two of the biggest indices in the world, which inadvertently garners an elevated level of global and institutional interest. As such, the incremental market demand is expected to add reinforcement to the relevant shortlisted names’ prospects of significant value appreciation. I leave this as a supplemental consideration at the end, rather than in the earlier filtration process, given Nasdaq 100 and S&P 500 constituents only had a minor representation across the population of tech multi-baggers observed in 2023 and 2024.

Conclusion

I aim to use the findings and takeaways from my retrospective dive into 2023 and 2024 tech multi-baggers to curate a fundamental-driven long portfolio that’ll be adaptive to and resilient against the evolving dynamics of forward market conditions. Based on the findings, stocks that demonstrate prospects of delivering critical fundamental considerations, such as multi-fold earnings growth and/or significant revenue acceleration, exhibit qualities of adaptiveness to evolving market conditions given their robust financial foundations. Meanwhile, those that are supplemented with additional qualitative traits, such as new product launches, could demonstrate incremental resilience against downside risks given additive growth prospects. Taken together, I will prioritize investigation into tech names across Nasdaq and the NYSE that are already profitable or are expected to turn profitable, with prospects of multi-fold earnings and/or revenue growth, over the next 12 to 24 months as the initial gateway to determining the best-performing fundamental-driven long trade ideas this year.

This analysis marks the first of two parts of my fundamental-driven long tech portfolio construction process. I’d value any feedback as I work on part II — finding the 10 constituents of my fundamental-driven long tech portfolio — which I’ll be sharing with you in a week’s time.

Thank you for reading.

Exhibits

Please click here to access the accompanying exhibits.

Disclaimer: This analysis is for informational purposes only and represents the opinions of Livy Research. It is not investment advice nor a recommendation to buy or sell the securities discussed.