SMCI: The PIPE Offering's a Telltale of Its Nasdaq Delisting

SMCI’s ongoing accounting debacle, filings delays, and Ernst & Young’s subsequent resignation have taken a significant toll on the stock’s performance. It’s pared some of the losses in recent weeks though – SMCI’s engagement of BDO as its independent auditor and Nasdaq’s gracious extension of the filing deadline to February have been huge helps. But it doesn’t stop one from thinking if the delisting risks have really changed enough since to warrant a sustained recovery in the stock.

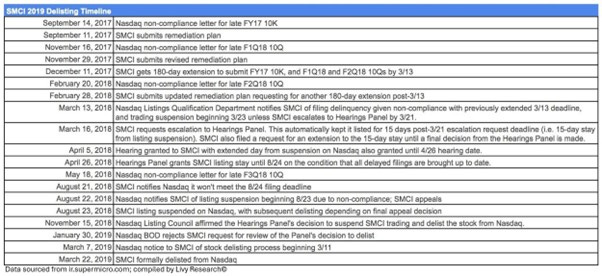

Remember, it’s not SMCI’s first clash with accounting-related filing delays and Nasdaq delisting risks. It’s happened before in 2017 – the whole thing dragged on for more than a year before Nasdaq bid SMCI goodbye and delisted the stock in 2019.

But SMCI didn’t have as much at stake at the time – it wasn’t a high-profile AI server provider, nor was it a S&P 500 company with substantial trading volume like it is today. Delisting risks are also high on the list of troubles facing SMCI today because of adverse liquidity implications tied to such an event if it were to happen. There’s an early cash redemption clause on the company’s $1.7 billion convertible notes that’d be triggered if the stock gets booted from Nasdaq.

Most importantly, SMCI’s latest capital raising efforts may be a telling tale that it won’t file in time and is heading for Nasdaq delisting. And CEO Charles Liang’s probably shot himself in the foot when he said otherwise just about a week ago.

The SMCI stock’s staged a nice recovery since the hiring of BDO and receipt of Nasdaq’s filing extension to February. But that’s likely the last hurrah before SMCI’s headed into another delisting spiral in the coming months.

SMCI’s Faces Imminent Delisting with Recent Fundraising Efforts

The trends observed to date show SMCI doesn’t take pre-emptive measures lightly. It’s not a big fan of taking mitigative actions as a “just in case” until it’s affirmative that the troubles waiting on the other side will happen.

For instance, SMCI only went on to prepay the term loans and other outstanding company debt (one after another) when it became evident the company wasn’t going to meet the renegotiated filing deadlines with the banks. And neither did SMCI pursue negotiation with the convertible note holders on a waiver clause for the early redemption in the event of a delisting – likely because it was confident in receiving the 180-day Nasdaq filing extension.

This implies SMCI’s latest capital raising efforts are in direct preparation for another round of filing delinquency in February. And management knows Nasdaq won’t be dancing around on the matter with them like it did in 2017.

The latest capital raising efforts represent a pre-emptive move by SMCI to mitigate post-delisting liquidity risks. Its pursuit of a Private Investment in Public Equity – or “PIPE” – is also a telling tale, since this arrangement can bypass disruptions from a potential Nasdaq delisting. A PIPE placement would give SMCI the wiggle room it needs with regards to filing deadlines and Nasdaq listing status, as long as the investors agree; this is a direct opposite from requirements under traditional fundraising through public markets. A PIPE also faces less regulatory hurdles with the SEC and grants the issuer faster access to capital. This is a critical consideration for SMCI, given the new Nasdaq filing deadline comes in less than two months with extended holidays in between.

The downside of an imminent PIPE placement is that existing SMCI investors will face the same dilution risks as if the company’s raising money through a public equity offering. Worst off, PIPE shares are also typically sold at a discount to market value to compensate for incremental risks associated with the investment – which is exactly SMCI’s case. This arrangement effectively heralds significant volatility to the stock, which SMCI’s already not in a shortage of given overhanging delisting risks.

How Close is SMCI from Being Delisted?

One might argue that CEO Charles Liang has only just given his word that SMCI will file by February 25 and not be delisted from the Nasdaq. But SMCI’s got a track record of making these empty promises – just like it did when it most recently renegotiated filing deadlines with the banks. What matters really is the action SMCI’s taken amidst the situation. This accordingly suggests that SMCI’s pre-emptive capital raising efforts and specific focus on the PIPE route is a direct response to an imminent filing delinquency and subsequent Nasdaq delisting.

This is further supported by the fact that Nasdaq’s unlikely to be as lenient as it did when SMCI repeatedly failed to file the FY17 10K and subsequent quarterly statements in time. So far, things have largely unfolded the same way it did in 2017 – SMCI’s delinquent on the FY24 10K due to accounting-related issues, and Nasdaq’s granted the first 180-day filing deadline extension.

But SMCI’s also dealing with a brand-new auditor this time to assess its books – this is an incremental challenge. A new audit engagement would require the auditor to perform additional work on prior filings before starting on the existing audit. This includes review procedures on FY23 statements to ensure the FY24 opening balance can be relied on when performing the audit. On top of that, there are additional audit procedures that’ll need to be performed given issues on the effectiveness of internal controls as cited by SMCI in its 10K filing delay notice. And some of these could potentially be tasks that BDO and SMCI won’t be able address by the February filing deadline even if there’s additional staffing working round the clock. To have the FY24 10K audited without issue by February 25 is an almost impossible task to fathom for an experienced auditor on a rolling engagement, and let alone a newly engaged one like in the case of BDO and SMCI.

To make matters worse, SMCI’s also officially been kicked out of the Nasdaq 100. It was earlier speculated that Nasdaq’s granted the initial 180-day filing extension to SMCI to buy time for index funds to regroup themselves. With that now out of the way, and Nasdaq’s knowledge of the immediate audit challenges facing SMCI, there’s one less reason to keep the stock listed on the exchange. It’s really no coincidence that word of SMCI’s capital raising efforts were reported around the same time it was booted off the Nasdaq 100.

What Happens When SMCI’s Delisted?

The SMCI delisting will take some time to materialize – even when it becomes delinquent with its filing on February 25. The last time, it took about seven months between the time when SMCI exhausted Nasdaq’s maximum 360-day filing extension (August 2018) and when the stock became officially delisted (March 2019).

But given SMCI’s current situation and history with filing delinquencies, it’s unlikely Nasdaq will give it the full 360-day extension (nor additional days of listing stay in between).

Once SMCI confirms it won’t file by the initial 180-day filing extension on February 25, Nasdaq will give it one week to request a hearing from the Hearings Panel. When this request is put through, SMCI is automatically granted a 15-day listing stay that begins after the hearing request deadline. SMCI can request for the 15-day listing stay to be extended until the Hearings Panel’s made a decision on whether to grant another filing extension – which is what it did successfully in 2018. If the Hearings Panel rejects SMCI’s plea for another extension, the company can still appeal to the Listing Council.

And if that fails too, then Nasdaq will notify SMCI of the stock delisting process, which takes about 10 calendar days before the name’s officially removed from the exchange. Prior to delisting, the stock can also be subject to suspended trading in the process of ongoing hearings and appeals. SMCI dropped 15% overnight when this happened in August 2018, highlighting the heightened volatility it’s subjected to amidst the process.

Once Nasdaq confirms SMCI’s delisting from the exchange, the early cash redemption clause on the $1.7 billion convertibles will be triggered. Based on SMCI’s current cash position, it likely won’t have the money to repay the convertible note holders even if a delisting doesn’t take place until late 2025.

SMCI’s latest “business update” reported $2.1 billion cash on hand as of September 30, 2024. Since then, it’s repaid $500+ in term loans, and an undisclosed amount related to outstanding lines of credit. Its ability to generate cash flows from operations also remain uncertain, given recent speculation on a string of “client exodus” in response to SMCI’s accounting woes.

This leaves SMCI’s ultimate liquidity stance up to its current PIPE capital raising efforts, which we believe will be sized according to the convertible redemptions and other working capital needs. If the PIPE funds can cover SMCI’s impending cash needs, then the company would be safe for now from an operating perspective.

However, the picture’s comparatively bleak from a valuation perspective. Once SMCI’s delisted, it’ll trade over-the-counter (“OTC”). Institutional stake in the stock would’ve significantly decreased by then. This is in line with current portfolio rebalancing taking place in response to SMCI’s removal from Nasdaq 100, and similar undertakings expected when the stock becomes delisted and removed from the S&P 500 as well. It's likely executive level management has also collateralized their respective stakes in the company for personal reasons. And these internally collateralized stakes could further fuel volatility when combined with institutional selling. Trading OTC is also significantly less liquid than public markets due to reduced institutional exposure and the cohort’s inherently elevated investment risks.

The last time SMCI was delisted, its share price had remained largely stable in OTC trading. But this was likely because its market cap was much smaller with limited institutional exposure at the time. However, there’s more at stake this time around given the prominence that SMCI’s technologies have risen to in recent years and the ensuing popularity it’s gained with both institutional and retail investors alike. A Nasdaq delisting and subsequent OTC trading will wreak havoc for the stock, even if subsequent liquidity risks are mitigated.

Key Watch Items Ahead

The first order of business would be to keep an eye out on the size and pricing of SMCI’s upcoming PIPE investment consortium. The closer the amount raised is to the $1.7 billion outstanding convertibles, the more likely SMCI’s preparing for filing delays and a subsequent Nasdaq delisting.

Developments leading up to SMCI’s extended February filing deadline are also crucial. They will underpin increased volatility to the stock, similar to the weeks leading up to Nasdaq’s initial filing extension decision in early December. In the event SMCI fails to file by February 25, markets should expect substantial institutional selling at the minimum, given the elevated risks of delisting that SMCI faces.

It's also possible that SMCI won’t be officially removed from the Nasdaq until later 2025 even if it doesn’t file by the February deadline. This is consistent with the administrative process of appeals and delisting-related paperwork as discussed earlier. Under such circumstances, SMCI’s accounting debacle would overlap with the new year’s PCAOB inspection results. And BDO’s high up on the list of troubled public accounting firms. This means any new inspection findings on BDO audits will directly impact the SMCI stock’s performance, as investors respond to implications on the company’s outstanding filings and Nasdaq listing status.

The PCAOB typically publishes their inspection reports for audit firms with findings in May. And BDO gets unusually high focus this year – not only because it’s been in the lead for inspection findings and material deficiencies by wide margins in recent years, but also because it’s been singled out by the Senate as the problem child.

In a letter dated October 9, 2024 to the PCAOB, the Senate’s specifically called out the integrity of BDO audits. The letter points to BDO’s 2023 audit deficiency rate, which reached an all-time high of 86%, ballooning from 66% in 2022 and 53% in 2021. BDO’s audit deficiency rates also lead the next-worst player, Grant Thornton, by 32 percentage points.

Given BDO’s decreasing audit quality, combined with historical penalties from the PCAOB that’ve been merely viewed as a “hand slap”, the Senate is now calling for greater scrutiny on the firm’s work.

This means the upcoming round of PCAOB inspection reports, particularly on BDO audits, will matter for SMCI. The audit firm’s tie-up with SMCI’s high-profile accounting saga doesn’t help with the airtime either.

BDO’s inspection results will directly dictate whether the eventual SMCI filing will be subject to another round of regulator inspections. If SMCI’s outstanding 10K and subsequent 10Qs are filed by February, then it’ll likely be subject to PCAOB inspection for the 2024 audit year. And if SMCI’s outstanding filings aren’t completed by early 2025, then the subsequent 2024 inspection report for BDO will cast a darker shadow over the validity of SMCI’s audit amid its complex accounting backdrop. And neither situations are beneficial to prospects of the SMCI stock.

Final Takeaways

SMCI’s been paring some of its losses since engaging BDO as its external auditor and receiving the filing extension from Nasdaq. But dismissing its delisting risks altogether would be a mistake.

My bearish outlook on SMCI is not so much about whether the company’s committed fraudulent reporting, but rather the concerns over its repeated accounting shortfalls and the subsequent implications of an imminent Nasdaq delisting. Given SMCI’s latest update on capital raising activities through a PIPE, I’m almost certain the company won’t be filing in time and is preparing to be booted off the Nasdaq.

And the troubles won’t end there, even if SMCI manages to dodge a liquidity spiral related to the early cash redemption on its outstanding convertibles. SMCI will likely face protracted uncertainties to its fundamental outlook, as suppliers and customers adjust for inevitable exposure to the sever maker’s unresolved accounting issues. This could very well lead to a further selloff in OTC trading as the company’s valuation corrects for related fundamental shortfalls. Reduced liquidity in OTC markets could represent an additional multiple compression risk for SMCI, which shouldn’t be overlooked.

This SMCI analysis marks my first catalyst-driven trade idea analysis on Substack. I’d value any feedback as I continue to experiment with the kind of information I’m hoping to share on this platform. Thank you for reading.

Disclaimer: This analysis is for informational purposes only and represents the opinions of Livy Research. It is not investment advice nor a recommendation to buy or sell the securities discussed.

Very well written. You bring up good points that have not been listed on other platforms. I would not even trade this stock.